Dr Luke Martinelli is a Research Associate in the Institute for Policy Research (IPR) at the University of Bath, and author of the IPR’s latest report ‘Basic income, automation and labour market change’.

As the IPR’s latest report explores, a great deal of recent interest in basic income has been driven by structural changes to the labour market and wider economy, caused by various aspects of technological change including automation of an ever expanding array of productive tasks and the emergence of ‘Superstar firms’.

Indeed, the desirability of basic income as a solution to forthcoming labour market dysfunction, and an ensuing breakdown of the ‘social contract’ between capital and labour, is hard to refute. Being universal and unconditional, basic income is arguably optimally flexible and minimally distortionary under any conceivable labour market and family circumstances, however uncertain and contingent the future might be.

And basic income is not only positioned as a ‘crisis response’ to forthcoming changes; it also serves to promote structural transformation towards a more productive ‘knowledge economy’ – easing life course transitions, facilitating education and re-skilling, and encouraging innovation and entrepreneurship. Additionally, basic income may provide a solution to macroeconomic demand deficiency and destabilising household debt.

If the issue of basic income’s desirability in the face of automation and labour market change is relatively clear cut, more controversial issues arise when we consider questions of feasibility: the specific political and institutional mechanisms through which basic income might take shape, and the forms it could take in terms of concrete design features.

We might expect that as the problems to which basic income poses an apparent solution swell, the policy will gain traction in the political arena to become practically an inevitability. In reality, the mechanisms through which basic income might appear cannot be taken for granted. The notion of ‘path dependence’ suggests that existing institutional structures can foreclose specific trajectories of policy reform. Basic income might be a preferable option if one were to design the system from scratch for the digitalised era, but it is perfectly possible that suboptimal policies will endure due to institutional legacies, entrenched vested interests, and the sunk costs of prior reforms all forged under very different circumstances. It is also worth noting here that a range of alternatives for dealing with technological and labour market change also exist. Basic income is not the only game in town.

Electorally powerful groups also oppose the reforms, on self-interested as well as more normative grounds. Significant marginal tax rises are required to pay for basic income’s progressivity, and under many variants of the policy, basic income’s considerable gross costs are offset by reductions in the value of existing social transfers. This appears to place labour market ‘insiders’ and those in receipt of generous earnings-related benefits and pensions in opposition to basic income; even if they were not necessarily worse off, basic income erodes their privileged access to welfare.

Our analysis suggests that labour market risk per se does little to augment support – until precarity becomes a lived reality – since individuals facing brief periods of disruption might prefer social insurance to basic income’s uniform payment structure. On the other hand, highly-skilled ‘outsiders’ – graduates in non-permanent or solo self-employment – do appear to be a burgeoning constituency of support. The question is whether automation and labour market change – higher levels of risk, more widespread disruption, and the increasingly sophistication of the tasks to which technological substitutes can be applied – are changing the arithmetic sufficiently to make basic income a practical reality.

The practical prospects for basic income relate not only to public support (or ‘demand’) but to political ‘supply’ – the extent to which political actors can offer practicable and affordable visions of the policy to address voters’ demands. The policy addresses the key concerns (growing insecurity and inequality) of the progressive left, among which support is most widespread. Left-wing variants of the policy – i.e. those which fit alongside additional (means-tested and contributory) welfare provisions and ‘capacitating’ social services – are clearly more realistic than libertarian proposals to replace the welfare state wholesale.

Such proposals inevitably have the effect of exacerbating poverty levels, unless they are paid at prohibitively high levels, while partial schemes have generally progressive effects on poverty and inequality at more affordable cost. Yet the left remains hugely divided on basic income. Those on the ‘labourist’ left (such as trades unions) are generally sceptical, favouring the reinvigoration of more traditional policy instruments. At the level of EU institutions, the dominant social policy paradigm – ‘social investment’ – is diametrically opposed to basic income. The upshot is that basic income has only really been embraced in minor Green and ‘new left’ parties, and not within the mainstream social democratic left.

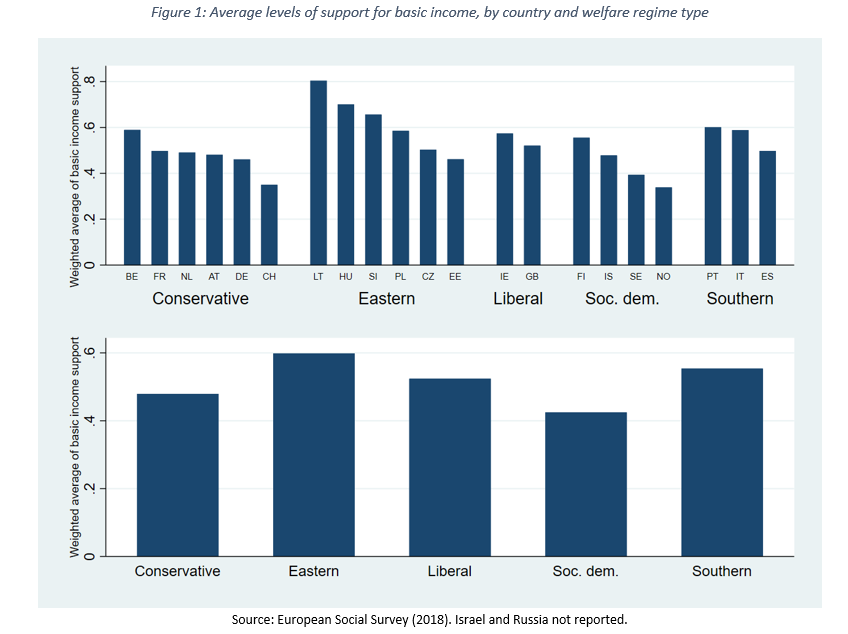

A final, further political difficulty to be considered relates to what Parolin and Siöland (2019) have termed a ‘demand-capacity’ paradox: that “countries which are presumably least equipped to implement a UBI see the most broad-based support for the policy”. ESS data show that levels of public support are lowest in Norway, Sweden and Switzerland, and highest among Lithuania, Hungary and Slovenia, as shown in figure 1. Comparing welfare ‘regimes’, average levels of support are highest within the less-developed ‘Eastern’ and ‘Southern’ welfare states, and lowest in the ‘Social Democratic’ welfare states, renowned for their comprehensive and generous welfare provisions.

Prima facie, poverty and inequality – in combination with the deficiencies of existing welfare systems – appear highly pertinent in explaining support for basic income as a radical, expansionary alternative to the status quo. The literature on the determinants of welfare preferences suggests that basic income’s potential for alleviating poverty may predict variation in support at the national level, and indeed we observe a significant, although admittedly rather weak, correlation between the two – as shown for various alternative basic income implementation modes in a recent working paper.

Of course, other characteristics of basic income – such as opposition to punitive conditionality – may also motivate public support, and there are likely to be idiosyncratic cultural factors at play as well. However, the number of poor households that stand to gain in financial terms from a basic income – and the manner in which this varies across structurally diverse welfare states – is clearly an important issue.

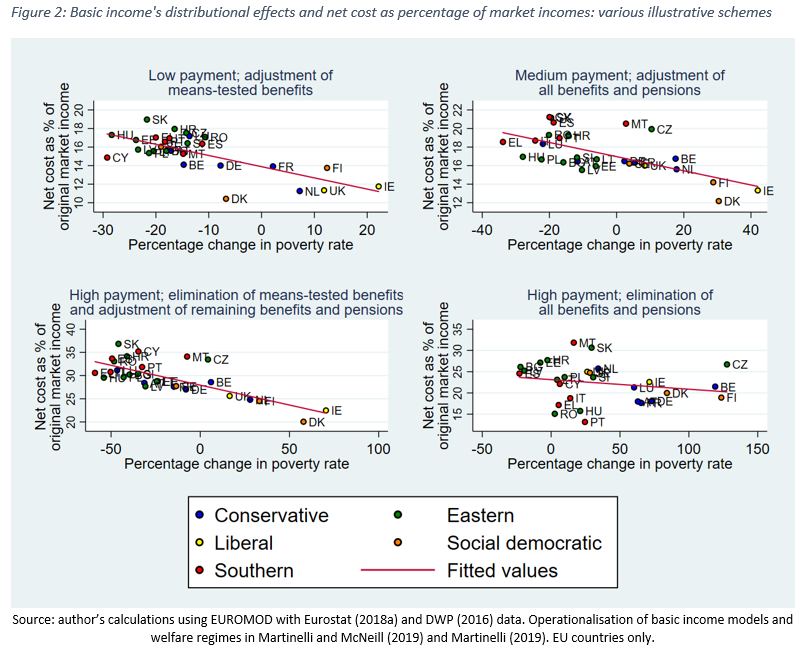

Basic income prompts more profound distributional improvements within countries in which existing welfare provisions are patchy and residual, at least for modes of implementation that partly or wholly replace existing provisions. In some of the more advanced Northern European welfare states in which targeting features heavily – such as Finland, the Netherlands, and the UK – even schemes that only partially replace existing means-tested benefits (top left panel of figure 2) can lead to significant increases in poverty rates. In contrast, countries which have less generous minimum income payments and higher rates of non-coverage of income support measures, basic income tends to be a relatively effective tool for poverty alleviation.

However, the poverty of existing welfare provisions means these countries cannot ‘claw back’ a great deal of existing expenditure by adjusting downwards or eliminating existing benefits, so that net costs (increases in fiscal effort) are relatively high. This is shown in figure 2, in which a general trade-off between net cost and poverty levels is apparent. The correlation is less clear in the bottom left panel, which represents a mode of implementation in which all other benefits and pensions are eliminated alongside the adoption of the basic income. This mode of implementation permits some countries with relatively regressive welfare systems (Romania, Portugal, Hungary, Greece, and Italy) to offset a large proportion of the basic income’s gross cost by repurposing generous earnings-related benefits and (especially) pensions with relatively little effect on poverty rates.

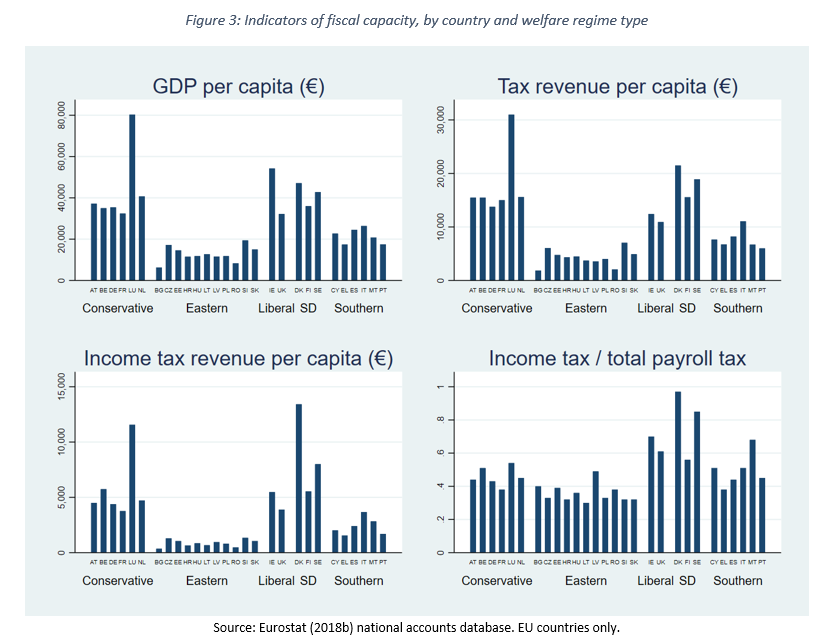

Countries with more widespread support and greater numbers of potential beneficiaries also tend to have lower aggregate income levels and undeveloped revenue systems (low tax takes, combined with a high reliance on forms of tax other than income tax, including social insurance contributions) – as shown in figure 3.

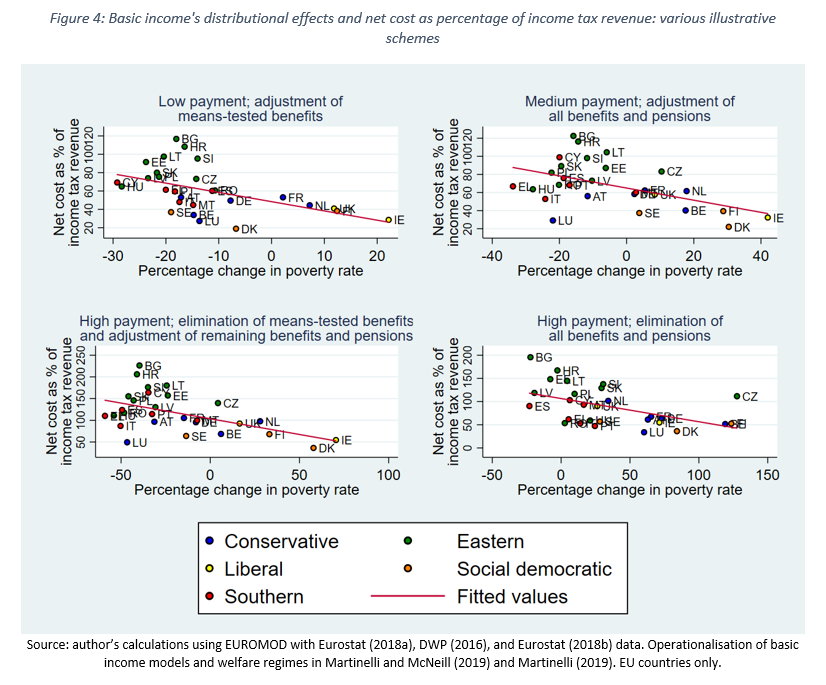

As shown, there is greater variation in income tax revenue than in per capita GDP or total tax revenue, with Eastern welfare states exhibiting particularly weak income tax revenue systems. If we assume, following Rogers and Weller (2014), that income tax systems are indicative of states’ capacities to raise additional funds – i.e. that ‘affordability’ is a function of cost in relation to existing levels of income tax revenue – this appears to exacerbate the demand-capacity deficit, as suggested by figure 4. As shown, using this measure, basic income’s cost becomes disproportionately high amongst the Eastern European welfare states.

Another difficulty, especially prevalent in states with highly dualistic welfare provisions (in which social transfers are insurance-based and strongly earnings-related), is that the reform of contributory systems is undoubtedly more challenging than reform to tax-funded welfare, due to opposition by labour market insiders of the erosion of their privileged access to benefits, as well as the role of social fund managers as potential veto players. This further erodes the capacities of governments to enact basic income by foreclosing the repurposing of social insurance expenditure. Thus, even when countries appear to exhibit favourable combinations of affordability and positive distributional effects – i.e. the countries grouped towards the bottom left of each panel in figures 2 and 4 – the capacity to ‘supply’ basic income is not assured.

As a general rule, basic income appears to pose greater implementation challenges in the contexts in which it would do most good and has the most widespread support. This is not to say that basic income is politically unfeasible. It is worth noting that there are other funding models besides the conventional combination of payroll taxes and adjustments to existing benefits. For example, land value taxes, taxes on corporate ‘rents’, and natural resource dividends could all contribute to finance a modest basic income in a highly progressive manner (although it would be difficult to fund a full basic income in this way). The evidence suggests that structural transformation and technological change may continue to augment the case for basic income. The challenge is to design schemes that attract broad levels of public support within fiscal parameters that do not discourage mainstream political parties – or make labour market insiders and pensioners significantly worse off. This may require proposals for more realistic payment levels, as well as greater modesty about what feasible basic income schemes can really achieve.

Respond