Dr Luke Martinelli is a Research Associate at the University of Bath Institute for Policy Research (IPR). Dr Aida Garcia-Lazaro is a Research Associate at the IPR.

The global public health crisis has caused unimaginable economic turmoil in a matter of months. Are the mainstream policy responses adequate to the task of preventing hardship and restoring economic vitality? Or, as many are now suggesting, is it time for an emergency universal basic income (UBI)?

The roots of the crisis

COVID-19 is spreading fast, with around 349,000 confirmed cases and 15,000 deaths since the outbreak began in Wuhan, China, in December. As the public health implications of the pandemic have become clearer – and drastic measures of travel restrictions, social distancing, mandatory self-isolation, and bans on public gatherings have been imposed across the world – so have the effects of economic devastation begun to emerge.

The effects of the pandemic are accelerating the announced global economic recession and markets are responding fast, operating on the demand and supply sides of the global economy. The outbreak in China disrupted global supply chains feeding into a decline in the demand for imported goods and oil, leading to losses for global businesses that rely on intermediate goods from Asian countries.

From mid-February, COVID-19 hit the financial sector with the biggest fall in the markets in 30 years. Oil prices collapsed last week as a result of the global demand for oil and the war of oil prices between Russia and Saudi Arabia, which further exacerbated this global predicament.

On the demand side, workers are facing income losses of uncertain duration. Especially affected are those with minimal income protection measures in cases of sickness or changes in the economic environment, such as insecure ‘gig economy’ workers, the self-employed, and small businesses. Even more serious than the impacts of ill-health on employment and income security are the effects of workplace closures, mandatory self-isolation, and layoffs by businesses facing drops in consumer demand. At the sectoral level, the travel and hospitality industries have been most profoundly affected, but no sectors or firms are immune.

Parallels with other crises – the financial and sovereign debt crises that followed the 2008 crash, and other pandemic disease outbreaks – are limited. In the case of the former, the crisis was one of credit and confidence; now, millions across the world have lost their capacity to work in the productive economy. And other pandemics have not spread nearly as rapidly and widely as COVID-19. Even though recent pandemics such SARS had higher fatality rates, COVID-19 is apparently more infectious in transmission. The pace of the spread and the numbers affected are unmatched since the Spanish flu pandemic of 1918, which eventually killed 50 million people.

An unprecedented public policy challenge

In this context, the challenges for public policy are vast and multi-faceted. First and foremost, there is the need to maintain and enhance the capacities of public health services and curb the spread of the virus. Then there are the immediate macroeconomic concerns of mitigating against recession, preventing insolvencies and layoffs, and maintaining balance sheets for firms and households alike.

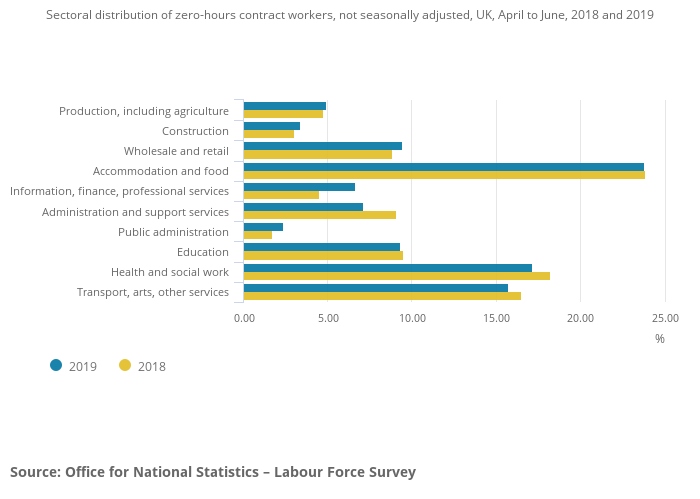

The pandemic has exposed how vulnerable our economic system is to threats such as these. At the individual and household level, there is the immediate risk of widespread destitution and homelessness. Official statistics suggest that around 2.8% of the labour force work in ‘zero-hour’ contractual arrangements, 5.5% are in temporary or fixed term contracts, and around 15% are self-employed – including large numbers of involuntarily self-employed, i.e. those who have entered self-employment after failing to secure adequate paid employment. According to Sonja Avlija, these statistics are likely to underestimate the scale of the problem.

Many of these workers have little or no protection against loss of income. Existing income replacement policies, already rather inadequate, are clearly unfit for purpose in the context of the pandemic. At £94.25 per week, UK statutory sick pay (SSP) replacement rates are among the lowest in Europe, at around 20% of wages (the precise rate is variable, as the benefit is flat rate). Other out-of-work benefits are even less generous, such as standard unemployment benefits which are £73.10 per week.

Of course, some - including gig-economy workers and the self-employed - would not even be eligible for this meagre support. And in addition to not covering all affected workers, and inadequately replacing lost income for those who are covered, existing sick pay provisions in the UK are counter-productive in the context of the present crisis: they provide incentives for unprotected workers to carry on working, thus exacerbating the spread of the disease.

It is surely essential that welfare provisions need to cover the contingencies of mandatory isolation and workplace closures, and provide more immediate, comprehensive and generous cover for sickness. In the UK, accommodation and support services, health and social work, and transport have the largest shares of the most vulnerable employees – and they are also among the hardest hit by drops in consumer demand.

But the challenge is not only to maintain household income. At the systemic level, household income losses will further reduce aggregate demand, causing insolvencies and shutdowns of production facilities, with negative multiplier effects. As Frances Coppola points out, “... maintaining people’s incomes protects landlords, banks and utility companies from defaults.”

Another goal is to support firms to survive and get quickly back on their feet, by providing loans and grants and bolstering the financial system. Firm support can be combined with measures encouraging or mandating them to keep employees on the payroll, thus targeting both objectives simultaneously. However measures on both sides of the market – demand and supply – are required to recover the global economy from this pandemic.

The response so far…

All affected countries have brought in significant new economic measures, although they have prioritised different aspects of recovery, and have exhibited varying levels of commitment and success.

One response is expanding the generosity and coverage of existing cash transfer schemes. As Ugo Gentilini of the World Bank notes, “... countries like Indonesia, Malaysia, China are anticipating, expanding, and increasing payments of their flagship cash programs.” India is also considering cash transfers to workers in the informal sector and Canada unveiled direct support for workers and extended tax credits to businesses.

European welfare states have responded with a combination of 'tax moratoriums, payment extensions on social charges, loan guarantees and wage subsidies for workers who cannot work or move to part-time roles'. Some of the reforms have been rapid and bold: Denmark is subsidising 75% of the salaries of monthly-paid employees who would otherwise have been laid off; Sweden is allowing firms to defer tax payments worth 6% of GDP; and Ireland has announced fast-track welfare payments to the newly unemployed and the sick, including the self-employed. Italy, Spain and the UK have implemented moratoriums on mortgage and utilities repayments, and other European countries have launched similar fiscal stimulus measures.

The UK’s announced package of measures, following an initially limited response, has been surprisingly robust. Besides support for costumers with mortgages, it has included loan guarantees worth £330bn to help businesses in preserving employment levels, along with £20bn of cash grants and tax relief to small businesses for assistance with fixed costs and cash flow. In a further announcement without precedent, the UK government compromised to pay grants covering up to 80% of the salaries of workers to preserve them in the payroll. The new plan is seeking to protect current jobs and its cost is estimated at around £78bn.

Monetary authorities in different latitudes have also responded to contain the effects of the pandemic. The Bank of England (BoE) and the Federal Reserve System (FRS) have announced programmes to provide liquidity to large firms by purchasing short-term debt in the form of commercial paper; in the UK, the Covid Corporate Financing Facility (CCFF) is the instrument. Additionally, the FRS, BoE, and the European Central Bank (ECB) introduced new or extended quantitative easing programmes (asset corporate bond purchases) that aim to mitigate the credit constraints in the markets. The ECB announcement of €750bn (£700bn) package of quantitative easing came after criticism for an initially lacklustre response.

The emergency UBI proposal

Despite their unprecedented nature, these responses arguably do not do enough to protect the incomes and jobs of the most vulnerable workers. As mentioned, some countries have made changes to welfare entitlements, but none cover the full range of circumstances faced by vulnerable workers. Ensuring that everyone – not just standard employees – are covered by the arrangements, is a novel challenge. Five million self-employed workers in the UK, many of whom have seen their income decimated, are understandably frustrated at the failure to provide an income support package similar to that offered to employees. There is growing political pressure to provide some relief to these workers.

Nor perhaps are the responses sufficient to prevent the global economy from sliding further into recession. The aim of the UK government has been largely focused on helping businesses to minimise the cutting of jobs, which could reduce the cost of a posterior intervention to support workers with sudden income losses. In short, the nature of the stimulus is heavily focused on the supply side of the economy. Although this package is welcome, it is not enough to get over the COVID-19 crisis since it does not attend the dramatic economic constraints that people are facing already due to closures and lower consumer demand. A comprehensive stimulus package that supports the demand side may be needed.

In this context, it is no surprise that calls for radical responses have proliferated. Perhaps the most prominent proposal is the distribution of emergency universal cash payments via ‘helicopter money’. This is an unorthodox monetary policy that has been much debated but rarely employed, which resembles quantitative easing in some respects. In the case of quantitative easing, the government purchases financial assets (corporate bonds) with the printed money. Whereas in helicopter money, the printed money is simply distributed as cash to the public to encourage consumption expenditure.

Advocates have made an increasingly persuasive case for UBI for a number of years now, bolstered by the implications of growing labour market dysfunction and the shortcomings of traditional welfare provisions for protecting individuals against poverty and risk. But the COVID-19 outbreak has provided new and vital impetus to promote UBI as a vital part of the emergency response. Even some UBI sceptics now consider it a credible and necessary proposal for the times. The SNP and some prominent voices within the Labour Party are now openly calling for emergency UBI; over 170 MPs signed a letter to the Chancellor to that effect.

There is some precedent already for the idea as a response to the crisis: Hong Kong announced in February that it would distribute $1200 to every resident as part of a package of stimulus measures. For a short while it seemed that the radical policy might have an even more prominent outing, after being heavily criticised for an inadequate and incompetent response to the crisis, Trump administration sources confirmed plans to send direct cash payments to every American household, following Mitt Romney’s earlier proposal. However, more recent announcements suggest that the payments will be withdrawn for higher income households, based on 2018 tax returns, implying that the payments would be far from universal, and would fail to cover large numbers of workers affected by the crisis. In any case, the administration’s $2tr stimulus package’s passage through Congress has stalled.

Is now the time?

Clearly, the case for an emergency UBI has never been stronger: arguments for the need to cover widespread income losses and maintain aggregate demand reinforce one another. Clearly, objections such as that UBI would ‘discourage work’ are rendered invalid in the present context – although that hasn’t stopped the architect of the much-criticised Universal Credit, Iain Duncan-Smith, from restating them. However, there remain two main questions that bear further consideration.

Firstly, is the delivery of a new benefit system – even if ‘ideal’ for the circumstances we find ourselves in – feasible in the requisite short time scale? Commentators such as Torsten Bell suggest not, citing limits to state capacities to get things done. Even if ostensibly simple to administer, UBI still requires a number of features in place – a single cadastre of beneficiaries, and a payment mechanism – that do not currently exist.

In this context, might it be better to prioritise using the variety of policies and institutions that currently exist for different groups in the labour market, and expanding (or introducing) payments through them? The focus could be on identifying self-employed and non-standard workers – perhaps using existing self-assessment information already held by HMRC, for example – and designing new provisions for them, while increasing the generosity and ease of access to those workers who are already covered by existing provisions. At the moment, no stimulus package has clearly targeted these groups – not even the unprecedented UK package subsidising salaries.

The question is whether creating a universal payment system is really the most efficient way to replace their lost income. UBI, being a flat rate, is not optimally designed for ‘consumption smoothing’, and would have to be very generous indeed to adequately cushion the worst-affected from the effects of the crisis, while being granted to those whose with unchanged incomes at the same time. In that context, UBI might require more time for deliberation to achieve a satisfactory settlement than circumstances allow.

Another argument against the immediate implementation of helicopter money is that now is not the time for a generalised demand stimulus; that “it would be far better to break out the helicopters when the virus has passed and people start emerging from their cocoons”.

Even if UBI may not be the most immediately feasible solution, the nature of this crisis has shown how inadequate social protection measures are for large proportions of the workforce, and how ill-equipped they are for large systemic labour supply shocks. Surely, in this context, advocates make a convincing case that the infrastructure for universal emergency payments must be put into place in advance of any similar crisis occurring.

Furthermore, we do not yet know the scale of the unfolding economic devastation. While in the immediate term the priorities must be to stem the public health pandemic; to protect lost incomes in the most rapid and efficient manner; and to prevent widespread defaults, insolvencies and layoffs; if the crisis lasts more than a few months, emergency universal helicopter money may become increasingly inevitable.

Responses