By Geoff Crocker, a professional economist writing on technology at www.philosophyoftechnology.com and contributor to Basic Income Earth Network, www.basicincome.org

1 Introduction – affordability as the prime objection to basic income

The most prominent objection to Basic Income in public debate is its affordability. This objection was key in the Swiss referendum of June 2016 and in TV debate of the 2015 UK Green Party election manifesto. Basic Income is a major macroeconomic proposal, and needs to be presented within a comprehensive macroeconomic resolution.

Basic Income advocates largely argue within the confines of financial orthodoxy which requires balanced budgets (see Martinelli4, van Parijs and Vanderborght5, Reed and Lansley6, Standing7). Their Basic Income proposals therefore require to be funded by tax increases or other spending cuts, and thus become tightly constrained.

This blog presents a more radical proposal. Its argument is that

- advanced technology economies increase the output/wage ratio

- this reduces the demand/output ratio, creating demand deficiency

- it also reallocates income from wages and benefits to shareholder dividends, raising inequality

- this makes Basic Income essential to maintain effective macroeconomic demand

- it also makes Basic Income a policy tool to reduce inequality

A radical heterodox corollary of this argument which crucially demonstrates the affordability of basic income is that

- advanced technology economies render fiscal deficit inevitable

This hypothesis is tested within Popperian methodology, by deriving its empirical implications and testing these against empirical data. The blog shows that the data which is available supports and confirms the empirical implications of the hypothesis and thus tends to verify rather than refute the hypothesis.

The conclusion is therefore that Basic Income is an economic necessity, correctly and inevitably funded by ‘Overt Money Funding’ or ‘helicopter money’ ie an annual deficit which is simply written off, as current recurring deficits essentially are written off to ever ascending but entirely notional national debt. An outline of the heterodox theory of money which is necessary for this conclusion is then presented.

This offers a radical Basic Income proposal which avoids the affordability objection of neo-classical financial orthodoxy, thus creating scope for a far more realistic level of basic income.

2 Hypothesis

In a thought experiment where

- a machine is plugged into earth to produce all output GDP goods and services

- government issues annual new vouchers to distribute the output

then it follows that

- 100% of GDP becomes unearned or basic income

- 100% of GDP becomes ‘financial’ deficit

The nuanced hypothesis from this thought experiment is that

- in high technology, high productivity economies

- an element of unearned or basic income is an economic necessity to sustain demand

- an element of government financial deficit is inevitable

Elements of this hypothesis are famous from Keynes’s treatment which is reviewed in Pecchi8.

The important conclusion is that, in the real economy, it is output GDP which renders consumption affordable, not government financial balances. This is also true for Basic Income which is rendered affordable by output GDP, not government financial balances which themselves derive their value, as does money in general, from output GDP.

3 Testing the hypothesis against empirical data

The ideal empirical test for the hypothesis would be to run a statistical regression analysis of

- a measure of technology intensity in the economy, which would be expected to rise

vs

- the output/wage ratio, which would be expected to rise

- the demand/output ratio, which would be expected to fall

- the unearned/earned income ratio, which would be expected to rise

- financial deficit, which would be expected to rise

Note that unearned income would include pensions, welfare benefits, dividends, consumer credit, and dis-saving. The hypothesis requires these to increase as a proportion of total disposable consumer income as technology increases productivity.

Data to this exact specification is not readily available, and its definition and compilation are part of a proposed research project.

Research of available data sets with the UK Office for National Statistics, OECD et al, does however generate sufficient surrogate data to partially test the hypothesis. This is necessarily reported in an ad-hoc heuristic methodology as a series of data observations from available data, rather than within a comprehensive determinative methodology.

Data observation 1

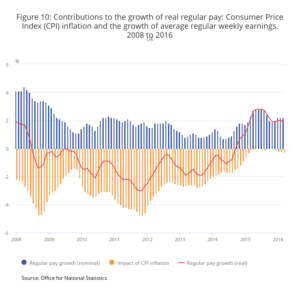

UK real earnings fell from 2008 to 2015 whilst consumption was sustained

Data observation 2

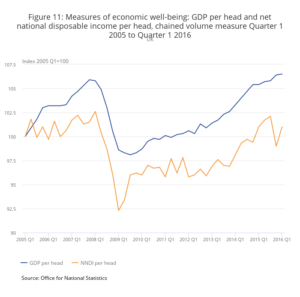

UK disposable income per capita fell below output GDP 2005-2016

Data observation 3

UK aggregate earned income fell continuously relative to consumer expenditure 1948-2016

The difference is the rise of unearned income which reached 14% of consumer expenditure by 2016

Source : UK ONS (note that ONS define ‘Labour income’=wages + self-employed income)

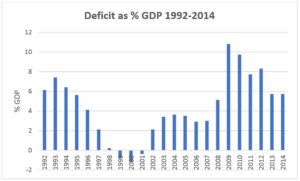

Data observation 4

The UK economy has run a deficit for 21 of the last 23 years

Source : UK ONS

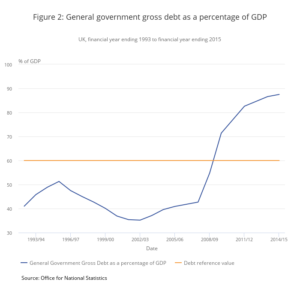

Data observation 5

UK government debt has continually risen 2003-2014 with no adverse effect on the real economy

Data observation 6

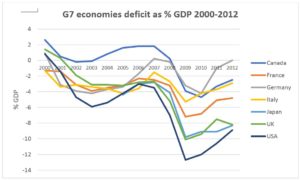

All G7 economies, with the occasional exception of Canada and Germany, have run a deficit over the last 20 years

Source : OECD

4 Interim conclusions

The above data observations all confirm the empirical implications of the Basic Income hypothesis ie that in high tech economies

- Unearned income is an economic necessity

- Basic income is a preferable version of unearned income, reducing inequality

- Financial deficit is an economic inevitability

It is particularly notable that 1995 represents a major turning point in the UK economy when consumer expenditure rose above aggregate wages and self-employed income, requiring various forms of unearned income to sustain consumption.

In 2016, consumer expenditure of £1.22tn was funded by £1.0412tn of labour income and £294bn of unearned income. Labour income thus met only 86% of consumer expenditure, so that 14% of consumption relied on unearned income.

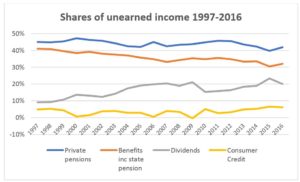

The following graph shows that the composition of unearned income has changed significantly over the last 20 years. Whilst private pensions and consumer credit accounted for relatively stable shares of unearned income, the notable change has been that

Between 1997 and 2016

- Welfare benefits including state pension have reduced from 41% of unearned income to 32%

- Dividend income has increased from 9% to 20% of unearned income

Wages and benefits have been relatively replaced by dividend income in the UK economy.

This has fuelled inequality as higher income shareholders benefit at the expense of lower income wage earners and benefit recipients.

5 Policy implications

Major policy implications are derived from this hypothesis and research ie

5.1 Economic crisis policy

Basic income replacing consumer credit as a component of unearned income would avoid economic crisis eg the 2007 crisis. Basic income creates less inequality than increasing dividends as a source of unearned income.

5.2 Austerity policy

Recognition of the inevitability of financial deficit renders austerity policy unnecessary. Consumer expenditure, basic income, and public sector expenditure are all rendered affordable by output GDP and not by the balanced budgets of financial orthodoxy.

6 Revisiting the theory of money

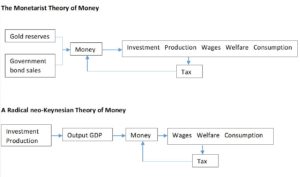

The financial orthodoxy which forces balanced fiscal budgets and thereby constrains basic income proposals to very modest levels, is a false premise.

The error results from an accountancy view of the real economy which as Keynes compelling demonstrated is a further causal false premise.

The consequence is that money is wrongly considered to be real, and to have inherent a priori value which then determines economic possibility and affordability. Historically, this view was incorporated in the Gold Standard whereby money in circulation was ‘backed up’ or constrained by gold reserves. The modern form of this error is that money in circulation is required to be balanced by the sale of an equivalent value of government bonds to investors. The reality is that money is virtual and only has value derived from its referral to output GDP (plus the historic accumulation of output GDP as assets, plus the output GDP potentiality value of land and raw materials).

A comparison of these two theories of money is shown in the following diagram

7 Conclusion

The blog presents a credible consistent model incorporating the economic necessity of unearned income, the superiority of basic income as form of unearned income, the inevitability of financial deficit to fund basic income, and considers the impact on economic crisis management and austerity policy. Initial research of empirical economic data supports the hypothesis of the model. A revised virtual theory of money enables the model intellectually and practically.

References

1 Geoff Crocker ‘The Economic Necessity of Basic Income’, Centre for Welfare Reform,

www.centreforwelfarereform.org/library/by-date/the-economic-necessity-of-basic-income.html

2 Geoff Crocker ‘Keynes, Piketty and Basic Income’, Basic Income Studies (June 2015),

www.degruyter.com/view/j/bis.2015.10.issue-1/bis-2015-0015/bis-2015-0015.xml?format=INT

3 Geoff Crocker ‘A Managerial Philosophy of Technology : Technology and Humanity in Symbiosis’ (Palgrave 2012) www.philosophyoftechnology.com

4 Luke Martinelli ‘Assessing the Case for a Universal Basic Income in the UK’ University of Bath www.bath.ac.uk/publications/assessing-the-case-for-a-universal-basic-income-in-the-uk

5 Philippe van Parijs and Yannick Vanderborght ‘Basic Income: A Radical Proposal for a Free Society and a Sane Economy’, Harvard University Press (May 2017)

6 Howard Reed and Stuart Lansley ‘Basic Income: An idea whose time has come’, Compass UK (May 2016)

www.compassonline.org.uk/wp-content/uploads/2016/05/UniversalBasicIncomeByCompass-Spreads.pdf

7 Guy Standing ‘Basic Income: And How We Can Make It Happen’, Pelican (May 2017)

8 Lorenzo Pecchi and Gustavo Piga ‘Revisiting Keynes: Economic Possibilities for Our Grandchildren’, MIT Press (2008)

This blog is the first in a two-part series. The second can be read here.

I very much welcome any comments, further ideas, and wider research findings - please contact me at geoff.crocker@3wa.co.uk. Thanks.

Further information including the case for basic income can be found at https://www.ubi.org