By Geoff Crocker, a professional economist writing on technology at www.philosophyoftechnology.com and contributor to Basic Income Earth Network, www.basicincome.org

Capitalism is in crisis, as formally acknowledged in the global 2007 economic ‘crisis’.

Still now, 10 years later

- pervasive inequality in the private sector

- the deprivations of austerity in the public sector

- consumer debt once again threatening mass default

all leave the system vulnerable, and failing to deliver economic justice and well-being.

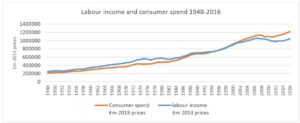

The cause is the decline in wages in the economy. The following graph shows that

- From 1948 to 1995, wage and self-employed income exceeded consumer expenditure

- From 1995 to 2016 wage and self-employed income became increasingly less than consumer expenditure

Source : UK ONS (note that ONS define ‘Labour income = wages + self employed earnings)

Labour income funded only 86% of consumer expenditure in 2016. The decline in labour income as a proportion of consumer expenditure is a long-term established phenomenon throughout the 68 years of this data stream. The Department of Work and Pensions 2015-2016 Family Resource Survey states that earned income accounted for only 71% of household income. The most likely cause of this trend is technological automation, which has inexorably changed the structure of the macroeconomic production function, increasing productivity and reducing the wage component of output.

The corollary is that unearned income now represents 29% of household income and 14% of consumer expenditure. Unearned income as a percentage of household income comprises

- Pensions (12%)

- Welfare benefits (9%)

- Dividends (6%)

- Consumer credit (2%)

The economy and people’s well-being relies on effective (ie funded) aggregate demand. Aggregate demand in turn now relies heavily on unearned income. The two problems with this model are

- Funding unearned income through welfare benefits hits the public sector deficit barrier

- The commitment to limit the deficit then triggers austerity policy

- Funding unearned income through increased consumer credit threatens default and crisis

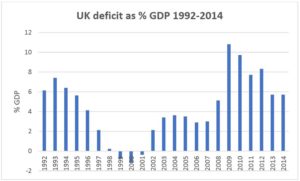

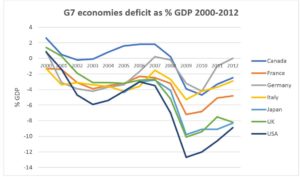

A radical alternative is needed. This requires a challenge to the assumption of financial orthodoxy that deficit is not permissible in the long run. The following graphs show that

- the UK economy has operated a deficit for 20 of the last 23 years

- All G7 economies, with the exception of Canada, and occasionally Germany, also operate regular deficits

Source : UK ONS

Source : OECD

Such persistent deficit, despite vigorous policy to eradicate it, suggests its inevitability. In a thought experiment of a totally automated economy, a machine plugged into earth produces all goods and services with zero wages. The output is distributed to consumers by annually reissued vouchers. These vouchers represent a deficit of 100% of GDP. The nuanced claim from this is that in advanced technology economies, unearned income becomes an essential part of consumer demand, and financial deficit becomes inevitable. Both these results are true in contemporary economic reality.

The crisis is real. The only resolution is a basic income as a new form of unearned income, funded by a deficit which does not link the issue of money to the sale of government bonds, but simply accepts the deficit being written off annually. Radical maybe, but intellectually defensible and practically implementable.

This blog is the second in a two-part series. The first can be seen here.

Responses

I'd welcome any comments, ideas and wider research. Please contact me at geoff.crocker@3wa.co.uk