Dr Aurelie Charles is a Lecturer in the Department of Social and Policy Sciences at the University of Bath. Damiano Sguotti is an MSc International Development student at the University of Bath.

What is the relationship between rising income inequality and increasing environmental damages? Both processes relate to the extraction of economic value without giving back.

Current environmental and economic concerns are best summarised by David Attenborough in his call to “curb excess capitalism”. The excesses of capitalism in terms of value extraction have long been pointed out by environmentalists and scholars in various disciplines across social sciences, but the fact that it now appears on mainstream media stresses out a paradigm shift that is most urgently needed.

One dominant feature of excessive capitalism has been the growing hegemony of shareholder value as a mode of governance of human and natural resources. If one is to channel financial resources towards a green recovery to repair our relationship with nature, addressing income inequality by repairing inter-group relationships is key to its success.

Throughout 2020, voices of the people arose to point out the painful structural inequalities experienced by the Black community worldwide. Starting in the US after the murder of George Floyd in Minneapolis, the social movement #BlackLivesMatter has been asking the State and Federal governments to recognise and account for the systemic racism faced by the Black community daily, in terms of access to health, education and economic opportunities. In the UK, the removal of the Edward Colston statue in Bristol made the headlines in June. We now listen more, and can hear, the voice of the Black community in mainstream media. In the US, Professor William S. Darity makes the economic case for reparations, while economist Darrick Hamilton promotes the idea of “baby bonds” to close the wealth gap between Blacks and whites.

Minority groups at the intersection of the most disadvantaged groups tend to absorb economic shocks. We’ve seen it in the low-paid service occupations during lockdown, and we can see it in the interdependence of earnings trends between demographic groups which tend to favour the rising trend in white financial accumulation.

In the UK, it is well documented that the Black group is at the bottom of the financial stratification by ethnicity, whether it is in terms of wealth, home-ownership and income. The trends between labour and capital earnings show a clear interdependency between the Black and white groups, and it is more evident when economic shocks happen. For example, after the 2008 recession, the income gaps between ethnic groups have widened, penalising minority communities.

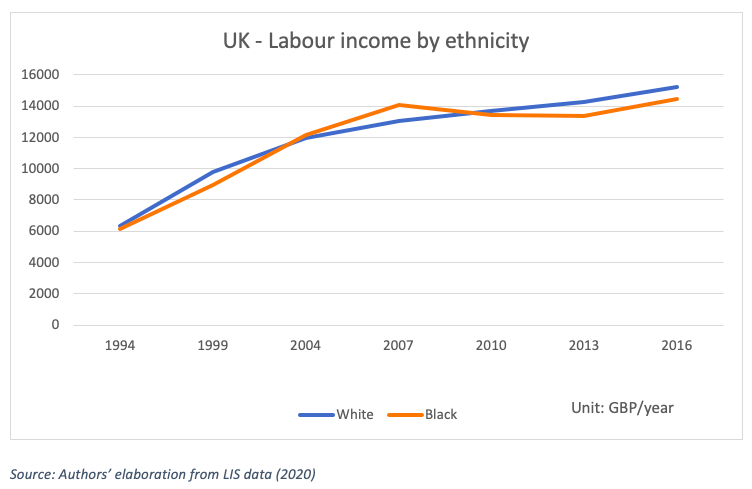

To understand the structural racial inequality in access to labour and capital income between white and Black communities in the UK, we looked at the trends of Black and white income over time, based on Luxembourg Income Survey data (2020). The first graph below represents the average labour income for the white and Black groups from 1994 to 2016. While the Black trend starts to overtake the white trend in the mid-2000s, the Great Recession brought the trends back to their “normal” dominant-dominated relationship.

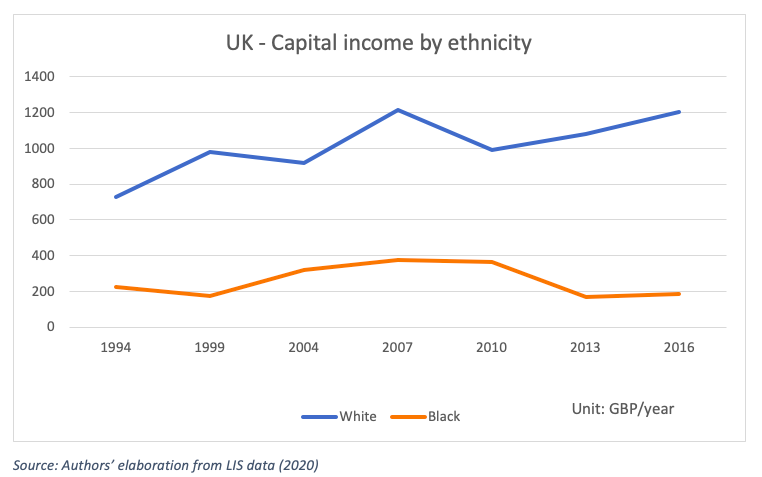

Similarly for capital income, which in the second graph, includes interest and dividends, rental income, and royalties. This graph in effect shows the average of all cash payments from property and capital (including financial and non-financial assets) for the Black and white groups. The evolution of the existing gap is quite significant in describing the relationship of power between the two groups in financial accumulation. While the white group benefits from a sharp increase in capital income in the built-up towards the Great Recession, the trend for the Black group is stagnant in the same period followed by an increasing capital income gap.

Just as nature thrives on diversity, current climate and environmental concerns should account for human diversity to create a resilient economic system able to recycle external shocks into productive economic opportunities. With financial flows able to reach quickly all parts of the society, an economic system is more resilient to external shocks, especially for health and services occupations which are essential for the running of a productive economy in times of crises.

Can we afford it? JP Morgan pledges $30 billion to address racial wealth gap, which as pointed out by Professor Darity, is 15 times the assests held by the top five Black owned banks, and just about 1% of JP Morgan Chase’s total assets. So, yes we can.

A starting point is for currency issuer countries to embrace the magic tree of Modern Monetary Theory as put forward by Stephanie Kelton. Structural inequality requires structural policies to heal the roots of a long-established system of discrimination, and make sure the green recovery thrives on healthy financial relationships.

All articles posted on this blog give the views of the author(s), and not the position of the IPR, nor of the University of Bath.

Are you a decision-maker in government, industry or the third sector? Apply now to our virtual Policy Fellowship Programme for access to University of Bath research and expertise. Learn more.

Register now for our upcoming lecture from Stephanie Kelton, co-hosted with the Bristol Festival of Ideas.

Respond