A major research collaboration between pension consultants LCP and the University of Bath has provided new insights into how pensioners choose to spend their money in retirement, revealing major differences across the pensioner population.

Steve Webb is a Visiting Fellow at the Institute for Policy Research (IPR) in addition to his role at Partner at Lane Clark & Peacock. Steve is a public policy expert with considerable political experience, including roles as Pensions Minister (2010 – 2015) and MP (1997 – 2015). Prior to his political career, he was an academic at the University of Bath. Dr Ricky Kanabar is a senior lecturer in the Department of Social & Policy Sciences and Research Associate at the Resolution Foundation, and his principal research interests are in the Social Mobility, Ageing and Health. Dr Aida Garcia Lazaro is an economist and researcher at the Institute for Policy Research & Economics Department.

Read the report ‘Downhill all the way’ here.

In the future, millions of people who work in the private sector will retire with a state pension and one or more Defined Contribution pension pots. As things stand, savers are largely left to their own devices as to how they draw on their pension pot through retirement. However, legislation shortly to be presented to Parliament will place a legal duty on pension providers to offer a ‘default’ post-retirement journey. In essence, this will shape how retirees draw money out of their pension if they make no active choices.

The big problem for providers is that there is limited evidence regarding the trajectory of pensioner spending in retirement. For example, should the money be front-loaded to support a more active early phase of retirement, or end-loaded to protect against rising prices and the risk of later life care costs?

To inform these decisions, our new report - ‘Downhill all the way’?’ – has analysed data on the spending patterns of over 100,000 pensioners collected over more than half a century as part of annual government surveys of households.

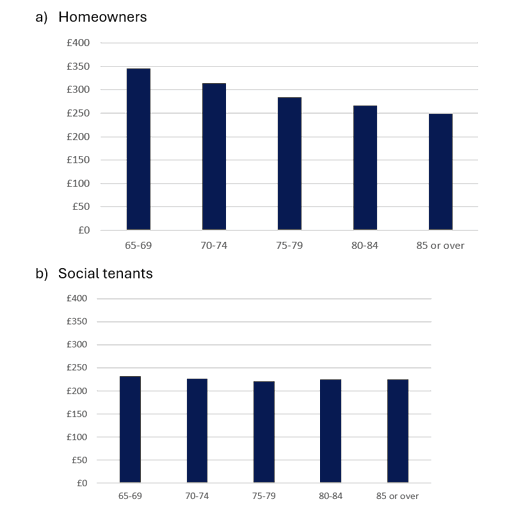

The starting point for designing post-retirement products should be analysis of what pensioners actually spend. This data provides startling evidence of the diversity of pensioner preferences and in particular that homeowners strongly prefer to spend more of their retirement wealth in the earlier part of their retirement, whereas renters may want and need a steadier income. The more that providers can find out about their savers, the more the post-retirement journey can be tailored to be a good fit for different groups of pensioners.

Steve Webb, Partner at LCP

Key findings are:

- For most pensioners retiring today with just a DC pension pot, the state pension will provide the majority of income in retirement. Under current legislation the state pension is expected to provide a steady real-terms increase in income through retirement.

- In terms of the desired profile of spending through retirement, there are major differences between different groups of pensioners. In particular, those renting from a social landlord tend to have relatively flat real spending which is relatively low compared to homeowners who tend to front-load their spending.

This is shown in the charts below:

Across the whole period from 1968 to 2019, homeowners are more likely to ‘front-load’ their spending than social tenants, with the downward slope for homeowner spending becoming particularly noticeable amongst the most recent retirees.

This research underlines the importance of understanding how pensioner spending changes across cohorts. In particular, pensioners are not a homogenous group and analysis by housing tenure highlights large differences in the spending levels and behaviour exhibited by each group. Further research on the determinants of pensioner spending in retirement and how this has changed over time is needed to adequately inform the design of drawdown products.

Dr Ricky Kanabar, Senior Lecturer at the University of Bath

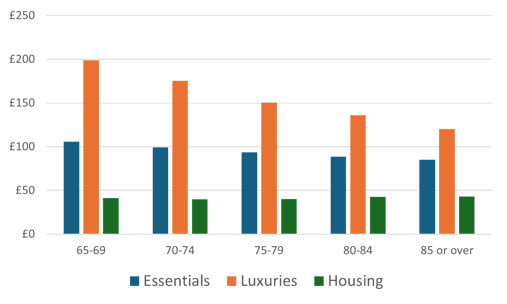

Further analysis shows that this downward profile of spending by homeowners (who make up around three quarters of the pensioner population) is driven by a front-loading of spending on ‘luxuries’, which drops sharply as they get older. This is shown in the chart below:

This research also sheds light on how becoming a widow affects income and consumption per head, particularly in the context of recent changes to state pension inheritance rights and the rising age at which individuals experience widowhood. Further research is needed to identify other key factors to differentiate pensioners. Our work will help inform policymakers to design more evidence-based policies.

Dr Aida Garcia Lazaro, Research Fellow at the University of Bath

Taken together these charts show the way in which income is drawn from pension pots by default should be tailored as far as possible by providers to reflect the diverse preferences and needs of different groups of pensioners. Going forward, given that most individuals who build up meaningful DC pension pots and who go into drawdown (rather than cashing out in full) will be homeowners, it is the spending pattern of this group that is of particular relevance to policy makers and pension providers.

Our key conclusion is that a ‘one-size-fits-all’ approach to pension decumulation is unlikely to be a good one. Our analysis suggests that providers should be customising their defaults based on key characteristics of their members, and that the needs of homeowners in particular may be very different to those living in rented accommodation in retirement.

Further work on this dataset will explore these differences in more detail using machine learning techniques. The data is drawn from the Family Expenditure Survey, the Expenditure and Food Survey and the Living Costs and Food Survey for the period 1968-2019. These are annual government surveys of household spending, income and personal characteristics. The full sample comprises data on over 100,000 pensioners.

This blog was adapted from a press release on LCP.com. Read the report ‘Downhill all the way’ here.

All articles posted on this blog give the views of the author(s), and not the position of the IPR, nor of the University of Bath.

Respond