Trawling through financial statements may not be everyone’s favourite way to spend an hour or two. I thought colleagues may find it helpful if I provided a quick summary of the 2017/18 Financial Statements.

As Bernie has mentioned in recent months, the University isn’t immune to the challenges faced by the sector as a whole. The Treasurer’s Report identifies the demographic changes in the number of 18 year olds, competition for overseas students, the potential for changes in regulated undergraduate fees as part of the Augar Review, pension costs and Brexit as the key risks facing the sector. The University also needs to ensure it effectively delivers its investments in IAAPS and the new School of Management. The Financial Statements describe the University’s risk management process on page 26 which addresses these risks.

The story isn’t only about challenge and risk; there is positive news too. The University’s research and teaching performance has been good in recent years and this has contributed to a good financial performance. The University has invested to support this growth and this level of capital investment is expected to continue for the next few years.

Given the uncertain picture those challenges present, our task is to make prudent financial decisions and careful investments to ensure we can make the most of opportunities and navigate through the next few years in good shape.

The tables below summarise some of the key information for those who want to know more, and the full 2017/18 Financial Statements are published on our webpages.

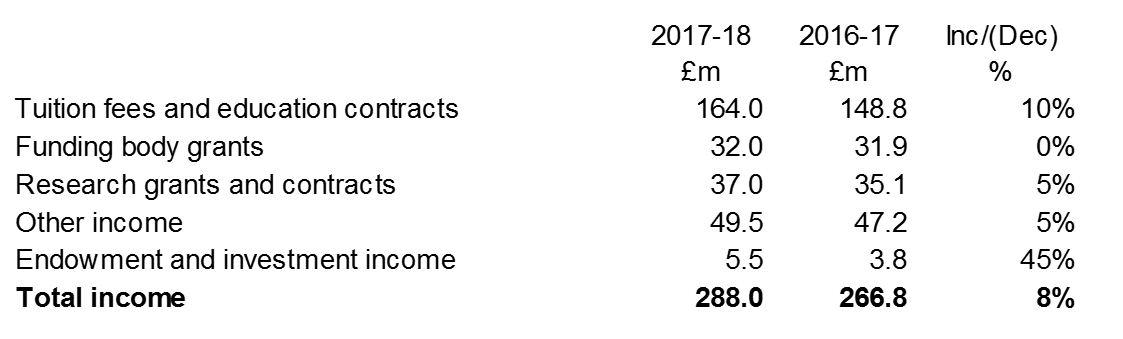

Income

Total income grew by 8% compared to the previous year. Tuition fee income grew in large part to an increase in the number of overseas PGT students.

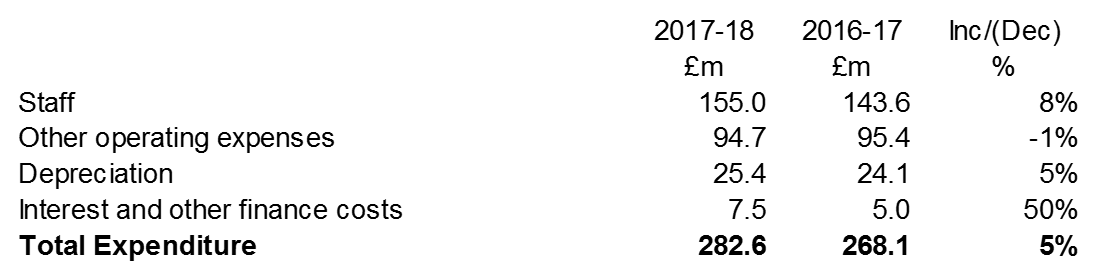

Expenditure

Staff costs increased by 8% as the University employed more staff and wage inflation increased costs. Staff costs also includes some of the impact of changes in pension valuations. Other operating expenses reduced in the year as the estates maintenance costs were substantially lower than the previous year which more than compensated for increases in other areas.

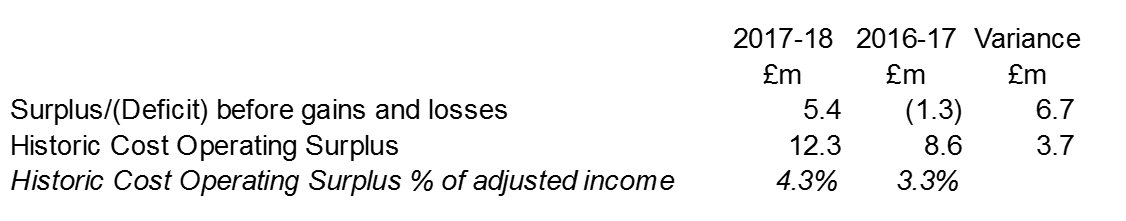

Surplus

The Financial Statements show a surplus of £5.4m compared to a deficit of £1.3m the previous year. This measure is impacted by a number of one-off and valuation adjustments so the University’s preferred measure is the Historic Cost Operating Surplus (more information on this on pages 10 and 77 of the Financial Statements 2017/18) which shows a surplus of £12.3m, an improvement of £3.7m compared to the previous year. 2016/17 included a number of investments in new courses and staff. The improvement in the surplus was expected as the new investments started to generate an income. Repayment of loans and capital expenditure will be paid from our surplus.

Cashflow, Capital Expenditure and Debt

The University generated £33m of cash from its operating activities during the year and invested £40m in buildings and equipment. At the end of the year the University had cash and investments totalling £213m which will be used to fund future capital projects, including IAAPS and the new School of Management building, as well as to repay loans. Outstanding loans at the end of the year were £250m. The University monitors its net debt position (see page 78 of the 2017/18 Financial Statements for more detail) as a ratio of the value of net assets. At the end of the year this ratio was low at 9.1% but it is expected to increase in the next few years as the major capital projects are built. In the long term these projects will generate cash to help repay the loans.