This year we are publishing an integrated Annual Report and Accounts for 2018/19. This combines our Annual Report and Financial Statements and takes a more holistic view of University activity, describing the resources we draw on, the value we add and the benefits our varied stakeholders receive. There are a growing number of universities adopting this integrated reporting approach with the intention of enhancing transparency and accountability and we hope to develop our reporting in future years.

If you want to look at the document, you can find it here, but I know that for some people a summary of the numbers is helpful.

Income

Total income grew by 8% compared to last year. Tuition fee growth was at its slowest rate for several years as the number of students grew by 1% and prices for home and EU undergraduates remain at £9,250. The lower rate of growth is in-line with the strategy to stabilise our undergraduate student population. Research grants income grew by 7% as did Other Income which is mostly due to an increase in accommodation income following the opening of Polden.

Expenditure

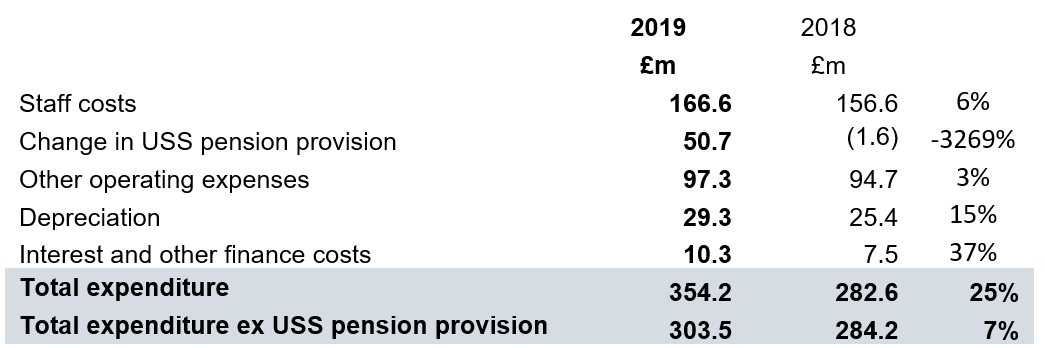

Excluding the USS pension provision our expenditure grew by 7%. Staff costs increased by 6% as staff numbers increased and wages increased. Other operating expenses grew at a little above inflation and interest costs increased as a result of the new loan to fund our capital programme.

Surplus

The accounts show a deficit of £44m but you will see that there is a charge of £51m in relation to the USS. There are several valuation and one-off entries in the accounts and the University’s preferred measure of surplus is the Historic Cost Operating Surplus. This is explained more in the accounts, but it provides a more consistent measure of our financial performance and, as we would hope, it is in line with last year at £12.6m. This surplus is used to invest in facilities for staff and students and to re-pay our loans.

I should say a little more about the USS pension charge. This charge of £51m is based on the 2017 USS valuation and represents the future cost of our deficit recovery payments. Many of you will know that there was a 2018 valuation and the results of this valuation will be shown in the 2019/20 accounts. The 2018 valuation took account of two of the four Joint Expert Panel’s (JEP) recommendations and was also at a point when asset market values were higher. Consequently, the USS deficit in the 2018 valuation was lower than in 2017. This means we will have a substantial credit in 2019/20 which will compensate for some, but not all this year’s, charge. If further illustration of the complexity of pension scheme valuations was needed, then this could be it. The University continues to support the JEP process as a way of providing a common agreement on the USS valuation as a first step to an outcome which provides a valuable pension for members at an affordable rate for both members and employers.

Cashflow

We generated £38m in cash during the year and spent £48m on capital expenditure. This is expenditure on buildings, excluding maintenance and running costs, as well as expenditure on new equipment. We also received £19m of capital grants this year mostly in respect of IAAPS. As a result, our net debt (the value of cash and investments less our bank loans) decreased to £45m. This net debt number will increase this year as our capital projects progress.

Risks

In addition to the risks associated with our own major projects the Annual Report and Accounts identifies several external risks including the funding of regulated fees, Brexit and pension costs. Self evidently, we are in uncertain times but there are opportunities too, such as our growth in on-line provision which started in 2018/19 and is growing well this year. We need to continue to maximise such opportunities taking a financially prudent approach, as well as managing the risks, to sustain our financial position.

Conclusion

The Annual Report and Accounts outlines some of the many successes we have had and the benefits that we bring to our numerous stakeholders. If you have the time, do take a look.