Dr Aida Garcia-Lazaro is a Research Associate at the University of Bath Institute for Policy Research (IPR).

This article is part of a series on universal basic income to coincide with the conference ‘Back to Basics: Income for Everyone?’.

We live in challenging and uncertain times with the pandemic, the war, and the energy and cost-of-living crises. All these make us question our views about implementing a universal basic income (UBI) scheme, which we define as a universal cash payment unconditionally delivered individually, without means testing or work requirement.

In previous UBI conferences, we have discussed the need for basic income as a response to long-run trends like technological change, automation and ageing. I want to focus here on the effectiveness of UBI in response to those issues, but also assume we live in an economy with high inflation. This seems closer to our reality now, and I hope it could spark a conversation about the affordability of services for potential UBI claimants when prices are soaring.

The Covid-19 pandemic represented a sharp disruption for millions of families in danger of losing jobs, particularly workers in the services sector with a low likelihood of working remotely. The health crisis sparked a global debate about the need for a basic income. In the UK, there was broad discussion followed by proposals from local authorities. However, national government dismissed basic income as it concentrated on the Job Retention Scheme and safety nets for the most vulnerable through the universal credit programme. In the US, the government implemented an emergency cash transfer programme for qualifying workers with gross incomes of $75,000 or less. This was not strictly considered a UBI scheme but was one of the closest experiments during Covid-19. In the global South, the ECLAC examined the idea of an emergency basic income scheme, releasing a report with scenarios and calculations, including the programme’s costs for the Latin American and Caribbean regions. However, the proposal was never implemented.

We began 2022 with the geopolitical conflict between Russia and Ukraine – or between the West and Russia-China, according to Henry Kissinger. This low-intensity war aggravated the inflationary spiral caused by the more structural global value chain disruptions initiated by the pandemic. The risk of an escalation and six months of conflict have exacerbated the increase in energy prices, eroding people’s living standards globally. The cost of living crisis is even more damaging for the British people, with the pound falling last week and the hike in the interest rate in reaction to the announcement of the mini-budget. The Bank of England had to respond by buying long-dated government bonds. Moreover, it is expected there will be a significant increase in the policy rate in November to mitigate further inflationary pressures. Although these policies aim to stabilise the economy will erode the purchasing power of households and increase the cost of mortgages.

While the current economic conditions and the long-run impact of ageing and automation provide arguments in favour of a UBI, the effect of soaring prices is important to consider in any serious basic income proposal. I do not discuss the popular argument against basic income, where basic income causes inflation. I am referring to the dynamic effect of inflation in the economy that affects the purchasing power of potential UBI claimants.

In economics, we usually compare wage growth against the consumer price index (CPI) growth to calculate households’ purchasing power loss. If the wage income of an individual grows at the same rate as the consumer price index, we could loosely argue that households maintain their living standards. Assuming wage income is the main income stream is a reasonable indicator of households’ purchasing power.

In a world with a UBI, we need to add the adjustment for inflation to UBI into the equation, otherwise there is a risk that the effectiveness of the cash transfer will shrink over time. We need a mechanism to ensure that the cash transfer amount rises with inflation. Unlike workers with labour market institutions to negotiate wages and salaries, UBI claimants do not have evident bargaining power, so the likelihood of an adjustment is subject to political and external forces.

To the best of my knowledge, the existing UBI proposals and studies set a fixed nominal amount of cash transfer. That is partly because the methods to simulate the cost of a UBI programme rest in static models that do not account for labour market dynamics and price changes.

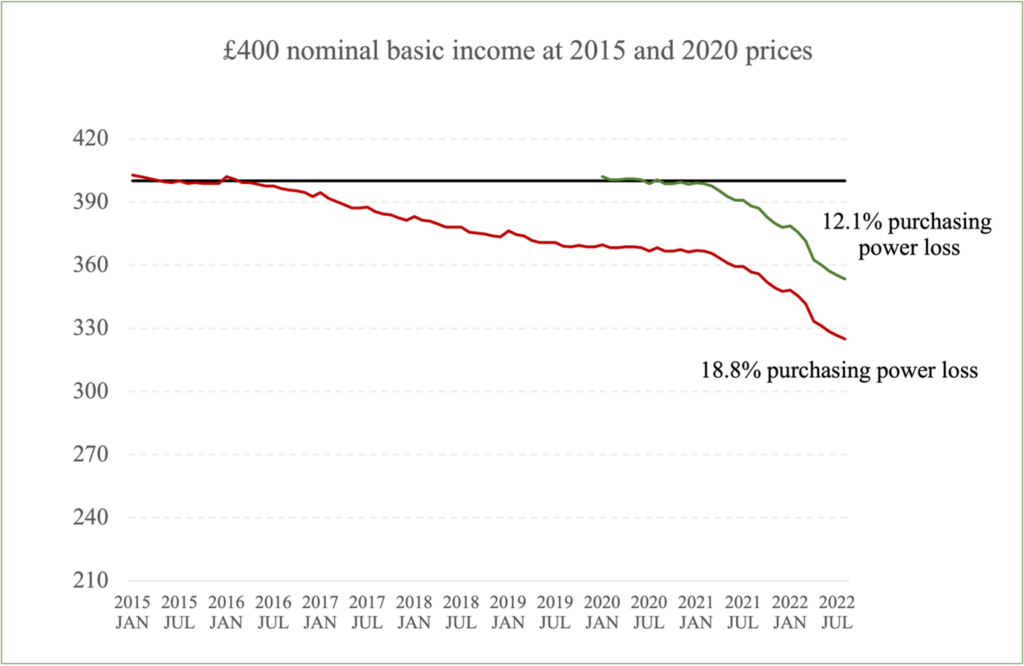

For instance, a hypothetical UBI scheme of £500 implemented in 2015 to tackle worker displacement due to automation would set the UBI at prices of that year. However, by August 2022 it would have lost 18.8 per cent of its value (see the red line, Figure 1) due to inflation. A second example could be the UBI implemented during the Covid-19 pandemic. Let’s assume the programme sets a cash transfer equal to £500 at the price of 2020; by August 2022, the purchasing power loss of its recipients is equivalent to 12.1 per cent due to the increase in prices (see green line, Figure 1). Over time, a fixed amount of money transferred to households shrinks because of inflation.

UBI advocates must include the inflation adjustment in the discussion. Adjusting income by inflation is essential in times of soaring prices. A basic income programme without a permanent price adjustment is a scheme whose effectiveness erodes over time, eventually compromising the programme’s primary objective. This should be addressed in future UBI proposals, with a more dynamic view of the economy.

An alternative proposal that implicitly adjusts the support for price changes is Universal Basic Services (UBS), expressed in a 2019 Labour party report, which provides arguments in favour of universal services like transport or education. However, UBS as an alternative is an interesting discussion for another blog entry.

This blog was produced in partnership with Bristol Ideas. All articles posted on this blog give the views of the author(s), and not the position of the IPR, nor of the University of Bath.

Find out more about our research on universal basic income and sign up now to our forthcoming conference, ‘Back to basics: Income for everyone?’, organised in partnership with Bristol Ideas and the Basic Income Forum, taking place 11 October 2022.

Respond